A GREAT THANK YOU to our valuable sponsors over the past 25 years

Financial Forum 2022

Financial Forum 2022

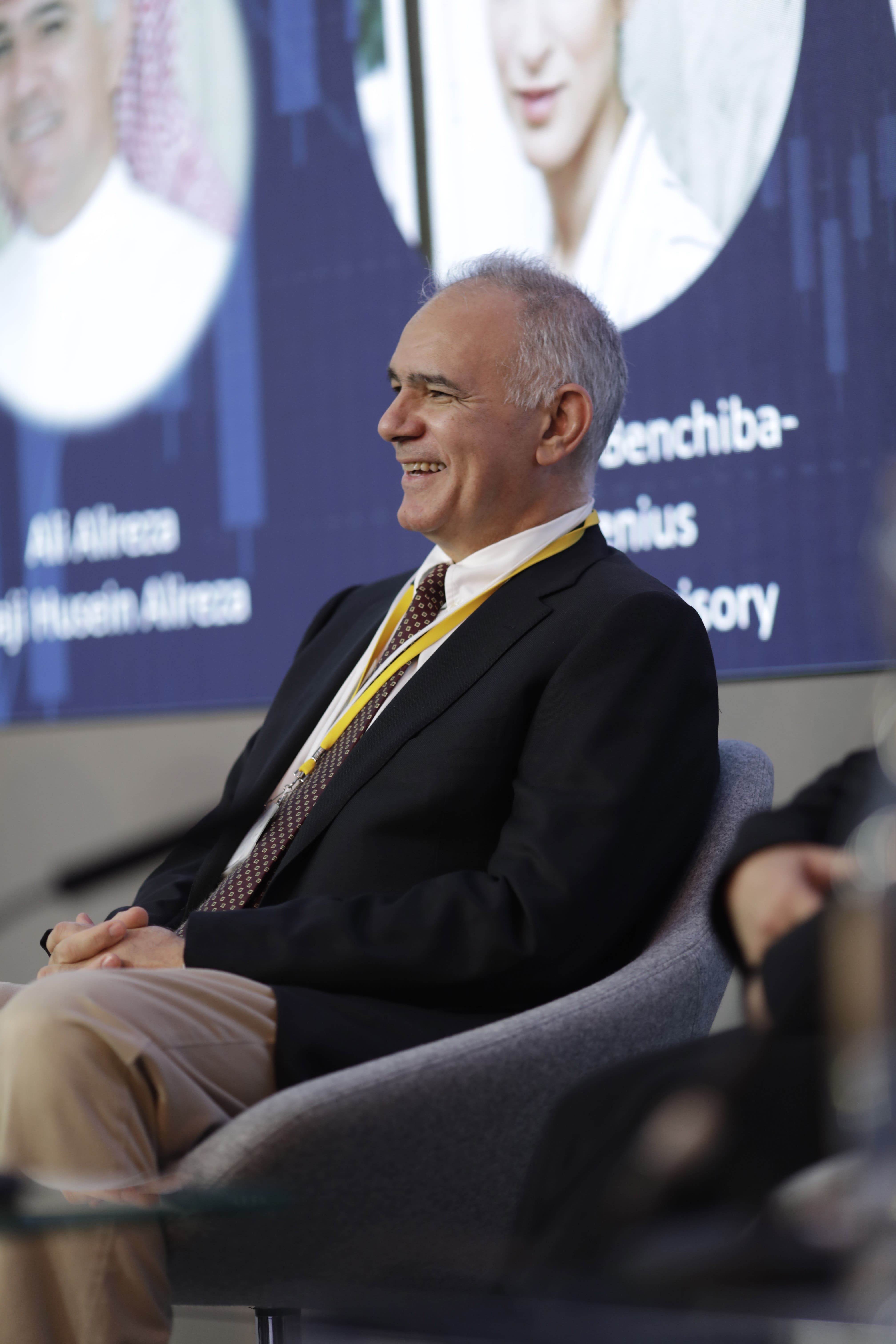

BMG Financial Group hosted its annual Economic Forum at the London Stock Exchange on July 26th 2022. The Forum was focused on investing for sustainable growth, ‘The Saudi opportunity now and beyond’. The Forum covered various topics including: Geopolitics, Dual Listings, Key Growth Sectors, the Nomu Market, SME’s, and the Future of FinTech.

Saudi senior officials, prominent businessmen, CEOs, etc, were among the distinguished faculty of speakers for the Forum.

The Forum was inaugurated by Basil Al-Ghalayini, CEO of BMG Financial Group, who spoke on the initiative of Vision 2030 for the Kingdom of Saudi Arabia, where a number of specialists and stakeholders in the financial and investment fields discussed the strength of the Saudi economy as well as the drive and appeal of both inward and outward foreign investment.

One of the main keynote speakers was H.E. Dr. Nabeel Koshak, CEO and Board Member from Saudi Venture Capital (SVC). He spoke in detail about the evolution of FinTech in KSA and the different initiatives that the government has launched including the Venture Capital Fund, the Monsha’at Fund and the new rules regarding the licensing of digital banks by SAMA.

Abdulaziz Al Ghifaili, The UK International Office Director from the Ministry of Investment, gave a detailed presentation on the national strategy of the Ministry in attracting foreign investment, while also highlighting the different initiatives that have been launched including the “Shareek” and the regional headquarters (RHQ) programs along with the Ministry’s plans to make KSA a global investment powerhouse.

Tom Attenborough, Head of International Business Development at the London Stock Exchange Group, spoke about dual listing and the different instruments that are being listed on the stock exchange such as Green Bonds. He also spoke thoroughly about the fact that his firm has frequent visits to Saudi Arabia meeting with CEO’s of publicly listed companies to explain the advantages of dual listing to them.

A number of speakers also expressed their optimism about the ambitious plans that have been put into practice on the ground relating to strengthening Saudi and British relations.

Al-Ghalayini concluded the Forum by thanking the sponsors including Haji Husein Alireza & Co, American Express Saudi Arabia, Baytur, Aggregate Holdings and Arab News.